Turning Challenges into Opportunities

As a real estate investor, one of the most lucrative opportunities lies in purchasing homes in disrepair. These properties, often overlooked by traditional buyers, present significant potential for profit. However, understanding the unique challenges and emotions faced by homeowners in these situations is crucial to securing a deal. In this blog, we’ll explore the mindset of a seller with a home in disrepair and how investors can build trust and offer solutions that benefit both parties.

Understanding the Seller’s Situation

Emotional Challenges

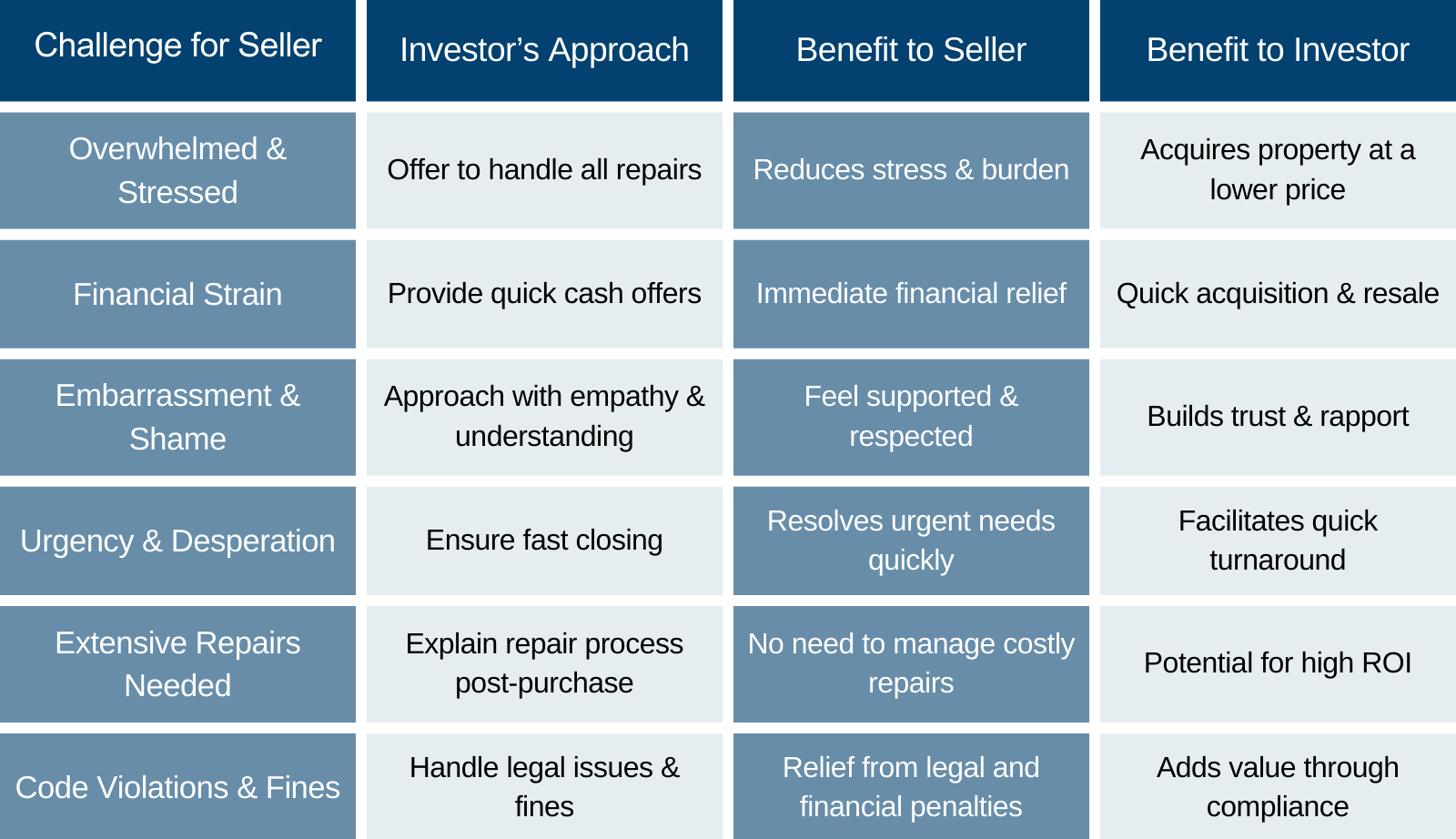

- Overwhelmed and Stressed. Homeowners with properties in disrepair often feel overwhelmed by the extent of the work needed. The thought of managing extensive repairs can be daunting, especially if they lack the financial resources or physical ability to undertake such a project.

- Financial Strain. Many sellers in this situation are dealing with significant financial stress. The cost of necessary repairs is beyond their budget, and they might be facing other financial obligations or debts that make investing in the property impossible.

- Embarrassment and Shame. There is often a sense of embarrassment associated with owning a home in disrepair. Sellers might feel ashamed of the property’s condition, which can make them hesitant to reach out for help or list the property traditionally.

- Urgency and Desperation. Sellers might be dealing with time-sensitive issues such as health problems, job relocation, or family emergencies. These factors create an urgency to sell quickly, often at the expense of getting a fair price.

Practical Issues

- Extensive Repairs Needed. The property may require major repairs like a new roof, plumbing issues, electrical work, or structural repairs. These issues can deter traditional buyers who are looking for move-in-ready homes.

- Code Violations and Fines. Homes in severe disrepair may not meet local building codes, resulting in fines and legal issues that add to the homeowner’s stress.

- Declining Property Value. The longer a property remains in disrepair, the more its value declines. This depreciation can put homeowners in a position where they owe more on the mortgage than the home is worth, complicating the selling process.

Building Trust with the Seller

- Empathize and Listen. Approach the seller with empathy and a genuine willingness to listen to their concerns. Acknowledge the emotional and practical difficulties they are facing. Show that you understand their situation by making statements like, “I can see how this must be really overwhelming for you,” or “It sounds like you’ve been dealing with a lot of stress trying to maintain this property.”

- Offer Solutions, Not Just a Sale. Position yourself as a problem solver rather than just a buyer. Explain how you can take the burden of repairs off their shoulders and provide a quick, hassle-free sale. Highlight benefits such as, “You won’t need to worry about fixing anything. We’ll handle all the repairs after the sale,” and “We can close quickly, giving you the cash you need to move forward.”

- Be Transparent and Honest. Transparency builds trust. Be clear about your process, how you determine your offer price, and any costs involved. Avoid making exaggerated promises and ensure the seller understands every step of the transaction. For example, say, “Here’s how we calculate our offer: we consider the current market value, the cost of repairs, and the potential resale value.”

- Show Previous Success Stories. Share testimonials or case studies of past sellers you’ve helped. Real-life examples of how you’ve assisted other homeowners in similar situations can reassure the seller and build credibility. Statements like, “Here’s a story of another homeowner we helped. Their property was in a similar condition, and we were able to close in just two weeks, allowing them to move to a new location without any further stress,” can be very persuasive.

- Provide Fair and Competitive Offers. Ensure your offers are fair and reflect the true potential value of the property post-repair. While you aim to make a profit, providing a competitive offer that respects the seller’s situation will foster goodwill and facilitate smoother negotiations.

- Follow Through on Promises. Reliability is key. If you promise a quick closing, make sure you deliver. If you commit to handling all repairs, ensure that the seller has no further obligations once the deal is closed. Keeping your word reinforces trust and can lead to referrals and positive word-of-mouth.

Investing in homes in disrepair offers significant opportunities for real estate investors. By understanding the emotional and practical challenges faced by sellers, and by building trust through empathy, transparency, and reliability, investors can secure profitable deals while providing much-needed relief to homeowners. This win-win approach not only enhances your reputation as an investor but also ensures a steady stream of motivated sellers eager to work with you.

Chart: Homes in Disrepair – Solve Your Seller’s Problems for a Win-Win