Help Your Sellers Solve Issues and Reap The Rewards

Inheriting a home can be both a blessing and a burden. While it’s a valuable asset, it often comes with a host of emotional and practical challenges. For real estate investors, these situations present opportunities to acquire properties at favorable prices while providing relief to sellers. In this blog, we’ll explore the complexities faced by sellers who have inherited homes and offer guidance on how investors can build trust and facilitate smooth transactions.

Understanding the Seller’s Situation

Emotional and Practical Challenges

- Emotional Attachment. Inherited homes often come with strong emotional ties. The property may have been a beloved family home, making it difficult for the seller to part with it.

- Grief and Loss. The process of dealing with an inherited property is often accompanied by grief and the emotional toll of losing a loved one. This can make decision-making particularly challenging.

- Maintenance and Upkeep. Many inherited homes have not been maintained properly, leading to issues such as outdated systems, needed repairs, or overall neglect.

- Legal and Financial Complications. Inherited properties can come with legal complications such as probate, unpaid taxes, or unresolved mortgages. The seller may not be equipped to handle these issues.

- Financial Pressure. The costs associated with maintaining an inherited property, including taxes, utilities, and repairs, can create financial strain, especially if the seller does not plan to live in the home.

Building Trust with the Seller

- Acknowledge Their Emotional Struggles. Start by acknowledging the emotional difficulty of selling an inherited home. Show empathy and understanding by saying things like, “I know this home holds a lot of memories for you and your family,” or “I understand how hard this time must be for you.”

- Be a Problem Solver. Position yourself as someone who can help alleviate their burdens. Explain how you can simplify the process and relieve them of the responsibilities that come with managing the property. Statements like, “I can help you avoid the hassle of repairs and showings,” and “I can handle all the paperwork and legalities for you,” can be very reassuring.

- Communicate Transparently. Be transparent about your process, how you determine your offer, and any associated costs. Clear communication builds trust and helps the seller feel more comfortable with the transaction. For example, “Here’s how I calculate my offer: we consider the current market value, the cost of necessary repairs, and the potential resale value.”

- Highlight the Benefits. Emphasize the benefits of selling to you, such as quick closing, no need for repairs, and cash offers. This not only makes your offer more attractive but also provides concrete reasons for the seller to feel relieved. For instance, “We can close in as little as two weeks, so you don’t have to worry about ongoing costs,” or “You won’t need to spend a dime on repairs or renovations.”

- Provide References and Testimonials. Share testimonials from previous clients who were in similar situations. Real-life examples can provide reassurance and build credibility. Statements like, “Here’s a story of another family I helped—they were able to sell quickly and move forward with their lives,” can be very persuasive.

- Be Patient and Supportive. Understand that selling an inherited home is a big decision and might take some time. Be patient and offer support throughout the process. Ensure the seller feels no pressure and has all the time they need to make an informed decision.

Investing in inherited homes offers significant opportunities for real estate investors. By understanding the emotional and practical challenges faced by sellers and building trust through empathy, transparency, and reliability, investors can secure profitable deals while providing much-needed relief to homeowners. This win-win approach not only enhances your reputation as an investor but also ensures a steady stream of motivated sellers eager to work with you.

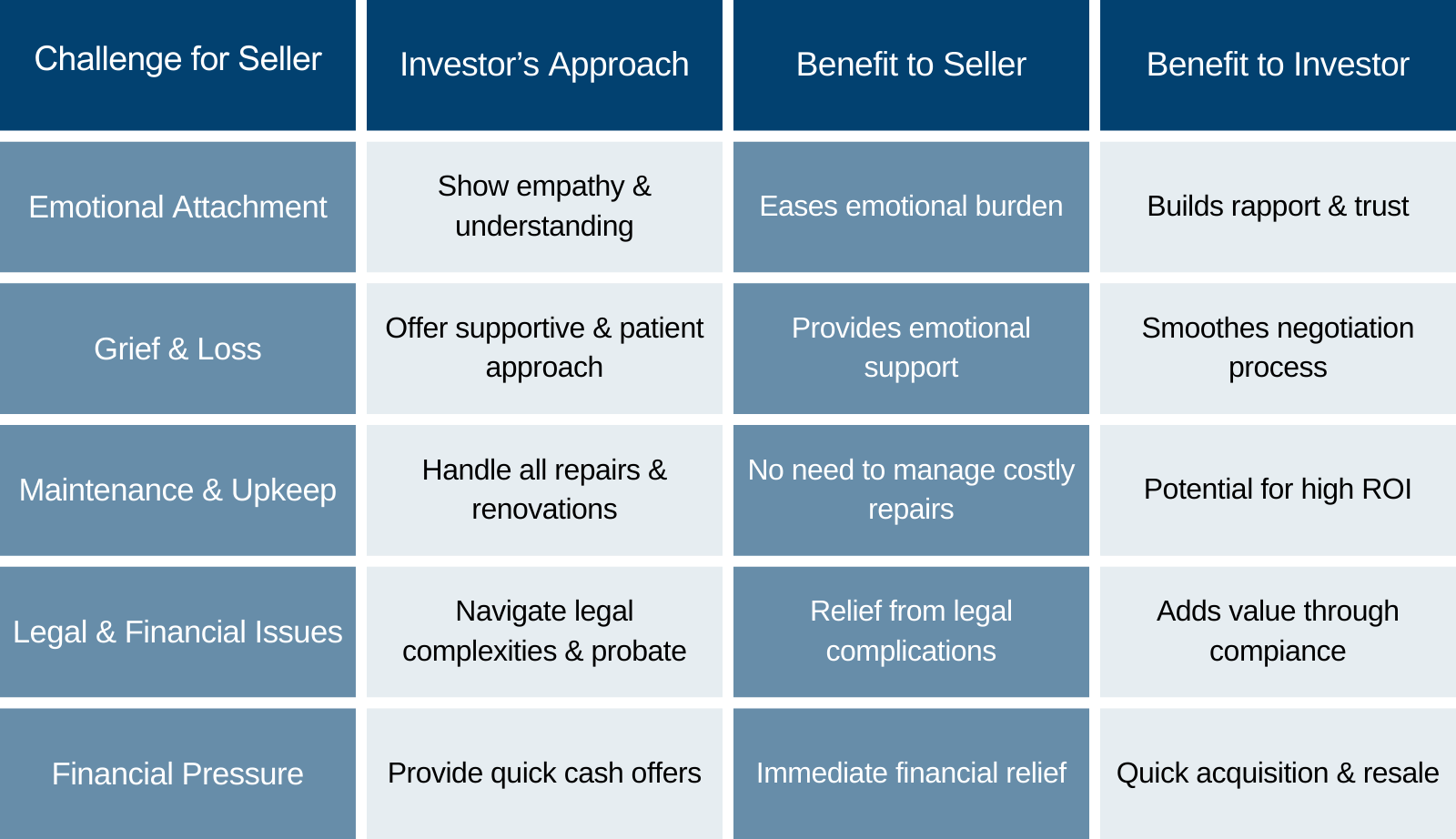

Chart: Inherited Properties – Solve Seller Problems for Max ROI